Sunday Morning / April 23, 2023

The Judicial Conference — the watchdog of the U.S. Supreme Court — has revoked the use of “exemptions” on financial disclosure reports U.S. Supreme Court justices are required to file.

Following Watergate, The Ethics and Government Act began requiring the High Court to file annual financial disclosure reports in 1978, but the Judicial Conference recently discovered loopholes that enabled the justices to omit many details. Personal hospitality aside, the watchdog now wants to know where, when, why and who, precisely, is bankrolling Supreme Court justices’ lavish lifestyles? The justices were served on March 14.

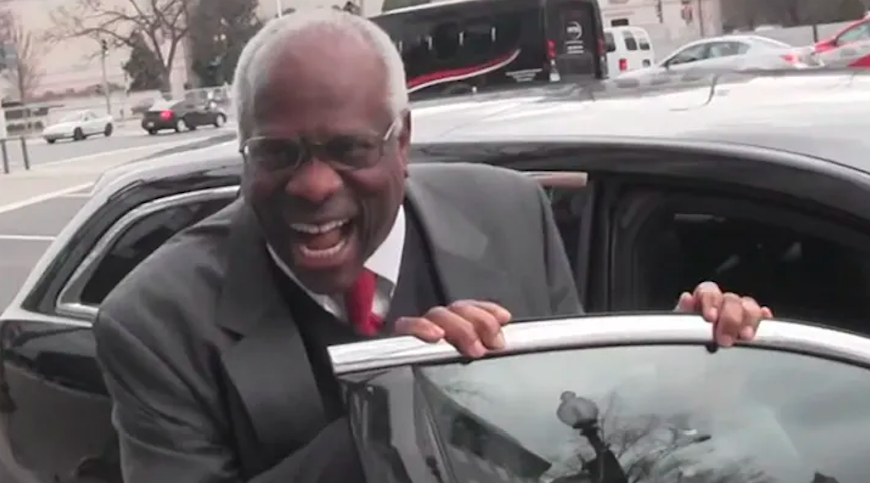

The call for transparency coincides with recent revelations between Associate Supreme Court Justice Clarence Thomas and Dallas billionaire Harlan Crow. Crow has donated nearly $5 million to Republican campaigns and conservative groups since 1997; and donated exactly $429,000 to current members of the Senate Judiciary Committee since 2001. But his personal relationship with Thomas appears to be a particular priority.

For each of the past twenty years, Thomas and his wife have accepted lavish invitations from Crow that include yearly luxury vacations via super yachts, private jets and luxury resorts. Moreover, Crow is spearheading an endowment to Thomas’ legacy beginning with a $105,000 donation to the Yale Law School "Justice Thomas Portrait Fund;” a $500,000 donation to his wife’s conservative political action committee Liberty Central; and the purchase of Thomas’ childhood home in Pin Point Georgia that Crow says, “is dedicated to telling the story of the second Black Supreme Court justice in American history.” There’ll even be a $19,000 Bible on display that once belonged to Frederick Douglass.

Tennessee State House

In 2014, Crow purchased Thomas’ 94 year old mother’s home in Pin Point Georgia, along with 2 vacant lots nearby, renovated the private residence and has allowed Leola Williams to live rent free for nearly 10 years. None of which Thomas has disclosed since ascending the bench in 1991 by George H. W. Bush, another benefactor of Crow. In fact, Thomas has been the recipient of more gifts than any other U.S. Supreme Court justice in history.The Gift Tax

The United States is comprised of federal, state, and local governments and each impose a tax. Taxes are levied on income, payroll, sales, property, dividends, imports, capital gains, estates and gifts. In 2020, tax collection amounted to 25.5% of the GDP, well below the OECD average of 33.5% among First World nations.

While taxes prioritize labor over capital income, gift tax according to the IRS is "any transfer to an individual, either directly or indirectly, where full compensation measured in money or money's worth is not received in return."

Gifts in the form of cash, stocks, real estate, tangible or intangible property are subject to tax. A gift is considered "completely gratuitous” if and when the donor receives nothing of value in exchange for the given property. A gift is considered "gratuitous in part" if and when the donor receives some value in exchange. While gifts are often given out of affection, respect, admiration or charity, the courts have defined a gift as “the proceeds from a detached and disinterested generosity.”

Non-taxable gifts include donations to political organizations; charities; tuitions; or medical expenses in someone else's behalf. In 2023, gifts may not exceed $17,000 per recipient; the lifetime limit is $12.92 million. Unless, of course, your a U.S. Supreme Court justice.Money Talks

“Money is a kind of poetry,” wrote Wallace Stevens, and apparently Thomas agreed when he urged the reversal of Buckley v. Valeo. "I believe that contribution limits infringe as directly and as seriously upon freedom of political expression and association as do expenditure limits." Thomas continues,

When we make a political donation, we are exercising our right to speak through the public servant with the expectation that our views on policy and politics are articulated and enacted into law. The pubic servant is the donor’s mouthpiece.

He cites, unapologetically, a passage from a 1972 treatise on money and politics in Colorado Republican Committee v. FEC.

Some views are heard if and only if there is financial support for the public servant voicing the position. We should refrain from casting aspersions on politicians that are too compliant with the wishes of large contributors, and accept the materiality of modern speech. Speech needs a substrate, substrates cost money, money entails donors, donors are wealthy. Like the rest of us, they seek to have their beliefs and positions instantiated in the law.

His opinions on money and politics focus on public servants, not appointed judges, rightly. Last week, Texas Judge Matthew Kacsmaryk was shopped to invoke a nationwide injunction on an FDA approved abortion drug (mifepristone) thats been available since 2000. On Friday night the U.S. Supreme Court intervened, enabling the drug which accounts for 54% of U.S. abortions to remain available. Though Thomas held in Trump v. Hawaii that “universal injunctions are legally and historically dubious," he conversely disagreed with the court's refusal on Friday night to invoke one.

Like Thomas, Kacsmaryk has omitted the name of a benefactor with whom he has holdings of $5 million from his annual financial disclosure report. "The Clerk’s Office has the name of the entity, actively screens incoming cases, and I would be automatically recused from any cases involving this entity,” says Kacsmaryk.

The point, Mr. Kacsmaryk, is not that the Clerk's Office has this information, but that litigants before your court do not. Transparency in the courts is key to accountability for the public, nation and people.Judicial Ethics

When the liberal titan U.S. Supreme Court justice Thurgood Marshall co-authored the Buckley decision, which held that campaign expenditures are in fact speech, he inferred the same about our contributions and taxes and gifts. While money is speech — shoring advantage of access and influence for the nation’s wealthiest citizens — perhaps the problem isn’t the presence of money in politics, but rather the distribution of wealth and privilege in the economy?

As contrary the claim may seem to a market based economy, it was the very argument invoked for democracy in the early days of the republic. Called the Father of American Education, Noah Webster claimed in 1790 that “the basis of a democratic and a republican form of government is a fundamental law favoring a general distribution of property.” Without equal distribution of wealth and power, liberty expires.

AP

If money is speech, then a republic will always go to the highest bidder. Every parent knows that equity in chores and allowances produce a democracy, but nothing to be fair beyond the home comes from “a detached and disinterested generosity.” We all have a stake in the American dream — no exemptions. Just ask the businessman from Omaha; who gave Thomas a set of $1,200 tires in coincidentally the same town Thomas declares an annual income from a company that simply doesn't exist.